Mortgage interest rates are driven by the Mortgage Backed Securities (MBS) markets, where mortgages underwritten to Fannie Mae and Freddie Mac standards are packaged and sold in the secondary markets in a manner similar to bonds.

Since the beginning of 2013, the MBS market has been on an evil roller-coaster ride, one whose intention is not to excite, but to terrify and nauseate. Mortgage Backed Securities have been hugely volatile, thus causing huge volatility in mortgage interest rates.

In September 2012, the Federal Reserve initiated their third round of so-called “quantitative easing,” a policy through which the central bank buys bonds in an effort to lower long-term interest rates. Currently the Fed buys about $85 billion in Treasuries and Mortgage Backed Securities each month. The Fed has said it will maintain its pace of bond purchases until the job market improves substantially. For quite some time now, The Federal Reserve has talked about the need to taper down their bond purchases as the economy recovers. However, until this past week, no “dates” had been mentioned for possibly initiating this tapering.

Since early May, the MBS market has been selling off and pressuring mortgage rates to rise. This selloff was initially triggered by May’s New Job Report and grew on fears of what might come out of May 22nd’s Fed statements. Unfortunately our worst fears came true. Federal Reserve Chairman Ben Bernanke stated the The Fed could decide to scale back the pace of bond purchases “at one of the next few meetings” if the economic recovery looked set to maintain forward momentum. Considering the next Federal Reserve meeting is scheduled for June 18th and 19th, Bernanke’s comments triggered an MBS selloff so dramatic, it looked like the market drove off a cliff. And mortgage rates rose in kind.

“We are certainly in for a bumpy ride for the remainder of 2013,” said Bryan McNee, a senior bond analyst with MBS Authority. “Prior to May (2013), mortgage rates drifted sideways and were at fantastic levels. But that certainly hasn’t been the case since May 1st and won’t be the case for the rest of the year either.”

If you’re in the market for a mortgage, what does this mean to you?

If you’ve thought about refinancing, STOP PROCRASTINATING! Make this your priority and contact my office. Together, we’ll analyze your situation and determine whether it’s beneficial to refinance. Last week’s market has shown us once again how an opportunity can literately evaporate in a day! Don’t become another statistic and kick yourself later because you waited too long.

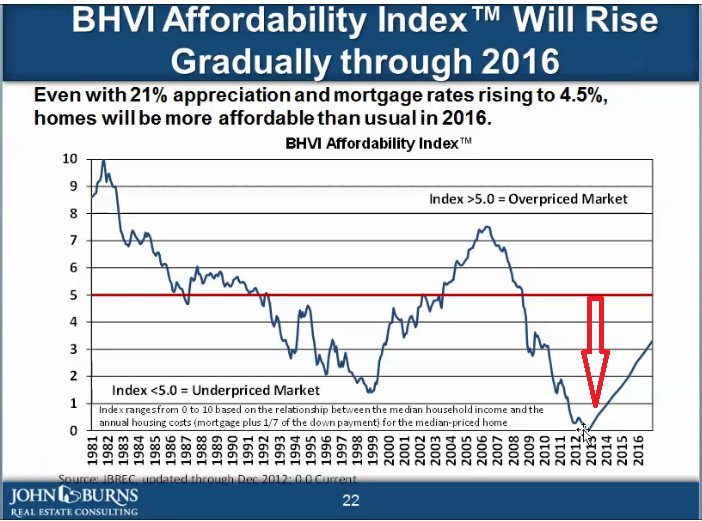

If you’re contemplating a home purchase, every statistic and indicator is screaming that the housing market is experiencing the best home-buying opportunities in over thirty years! (See graph.) Though rising, rates are still at historic all-time lows. Home values have leveled off and are already rising once again. It should be crystal clear that now is the time to buy a home.

Don’t entrust your mortgage to anyone but the most competent, qualified, and Certified Mortgage Planning Specialist®. We can ensure your new mortgage matches your needs, complements your financial plans, and helps you attain your financial goals. And guess what? The rates and fees you’ll receive are probably about the same as if you went to “Your Bank.”

Warren Goldberg is President of Mortgage Wealth Advisors, a Certified Mortgage Planning Specialist®, and a published author. His interviews include Blog-Talk Radio, Newsday, and the Long Island Herald. Since 1992, he’s been sharing his financial knowledge and wealth-building strategies, including how to properly use your mortgage as a financial tool. His clients regularly express their trust and appreciation by recommending friends and family call when in need of mortgage, real estate, and financial guidance.

Leave a Reply